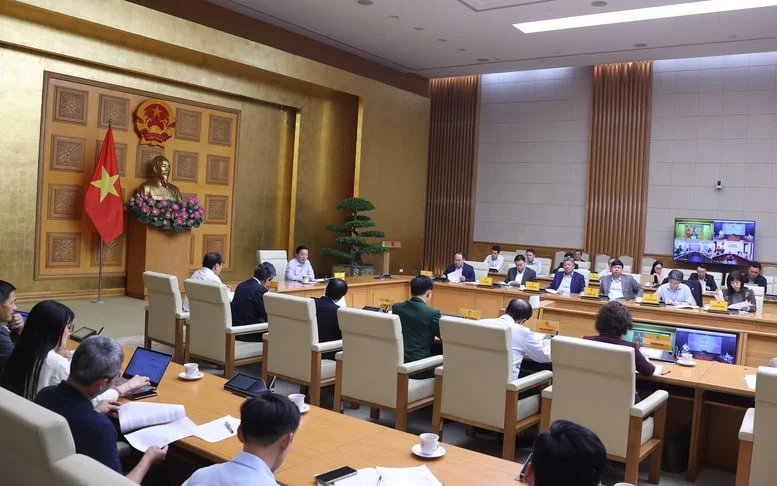

Under the framework of action plan of Advisory Council of Administrative Procedure Reform (“ACAPR”), the Government Office and ACAPR continued to listen to the sharing of enterprises on difficulties and obstacles in implementing mechanisms, policies and administrative procedures. Meeting on 4th May mainly focused on taxation, customs, import and export. These are one of the most concerned issues of not only businesses but also being the key discussion topic of public and media in recent time.

In the opening speech, Minister Mai Tien Dung, stressed that in the regular meeting of the Government on socio-economic development in the first four months of the year, the Prime Minister emphasized the importance of the continuation of the improving the mechanisms, reducing business conditions and administrative procedures reform to attract more investment, create favorable conditions for enterprises and liberate social resources.

According to the Government's Office, from 2017 up to now, ministries have cut 402/638 categories of goods need to have specialized inspection, planned to reduce 1,141 business conditions, planned to simplify 2,118 business conditions, bringing the total number of business conditions expected to be cut to 3,259 / 5,786 business conditions (simplified reductions reach 56%).

Especially in the field of taxation, customs, import and export, some reform results have come to life. From 2016 until now, there are up to 405 tax procedures and 223 customs procedures have been reviewed, reduced and simplified. Implemented information technology applications in the field of taxation (online tax declaration, online tax refund …) and customs (National Single Window, ASEAN Single Window). In addition, there are significant reduction of tax payment time from 420 hours in 2013 to less than 111 hours in 2017, and time for customs clearance of goods from 42 hours in 2014 to 34 hours in 2016.

On import and export, some reforms such as the pilot mechanism of auction rights to use tariff quotas instead of allocation of tariff quotas for sugar. Link to the National Single Window for online import licensing level 4 for large motorcycles, ozone depleting substances.

Attending the meeting, Mr. Minh Nguyen, EuroCham Board member also raised some issues and recommendations on Import & Export procedure specifically on National Single Window, ASEAN Single window and implementing the modern customs bond system to improve customs clearance. Besides, Mr. Minh also mentioned the “substance over form” mindset to be implemented on tax and customs inspection, with reference to difficulty in VAT refund or determination of Consumption norm of raw materials imported for export processing; Collaboration among the Ministries in dealing with tax and customs issues for enterprises such as Personal Income tax for foreign experts working for iNGO and Personal Income tax for foreign experts coming to VN to perform ODA funded projects…etc. Ms. Hoang Thi Kim Hue members of Mobility Sector Committee also shared the concern of European enterprises in Mobility sector on Special Consumption Tax Cap that should be increased from 7% to 15% in automobile industry; Credit/refund of Special Consumption Tax for additional tax paid due to customs revaluation; Increase of VAT for vehicles, spare parts and accessories from 10% to 12% and the implementation of the Decree 116/2017/ND-CP and Circular 03/2018/TT-BGTVT. Other tax and customs matters mentioned by Eurocham Sector Committees were also shared by other participants in the meeting.

In summary, Mr. Denis Brunetti expressed the appreciation of European business community to Vietnamese Government for their efforts in recent year to improve the mechanisms, policies and administrative procedures. With the upcoming EU-Vietnam Free Trade Agreement expected to be ratifies, it was crucial to clear the ground –level issues and pave further way to welcome the FTA with more market access, transparency and efficiency both in terms of costs and timing to attract and maintain European interest in Vietnam and EuroCham committed to work closer with Vietnam Government in this progress. Minister Mai Tien Dung concluded the meeting dialogue with appreciation to the recommendations of businesses and would direct ACAPR and Office of Government to summarize and report to Prime Minister at soonest for his direction especially issues related to Tax and customs procedures.