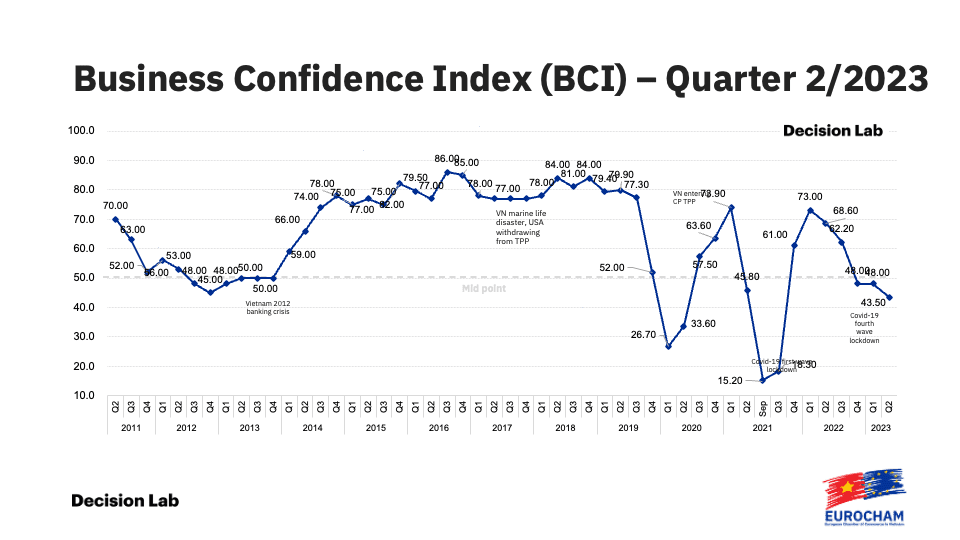

EuroCham Vietnam, the voice of the European business community in Vietnam, has released the results of its highly anticipated Business Confidence Index (BCI) for the second quarter of 2023. Conducted by Decision Lab, the BCI reveals a modest decline of 4.5 points in European business confidence towards the Vietnamese market, with the current score of 43.5 reflecting prevailing market conditions. Click here to access the entire BCI report.

The quarterly Business Confidence Index (BCI) serves as a vital tool for understanding the perceptions of European companies and investors in the Vietnamese market. By collecting feedback from EuroCham Vietnam’s extensive network of 1,300 members across a diverse range of sectors, this survey provides valuable insights into the current business landscape in Vietnam and offers a glimpse into future expectations.

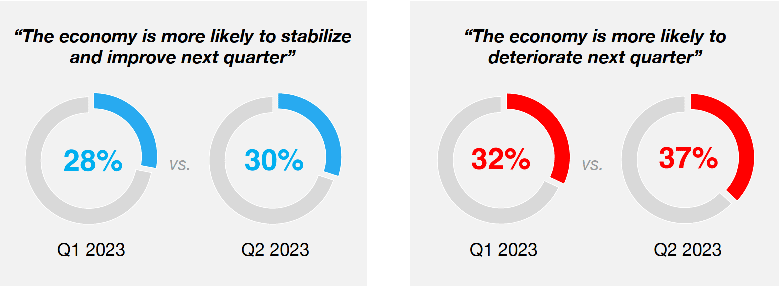

Moderate Increase in Economic Optimism

The report delivers moderately reassuring news as it reveals a marginal 2% increase in the proportion of businesses anticipating economic stabilization or improvement, bringing the total to nearly one-in-three respondents.

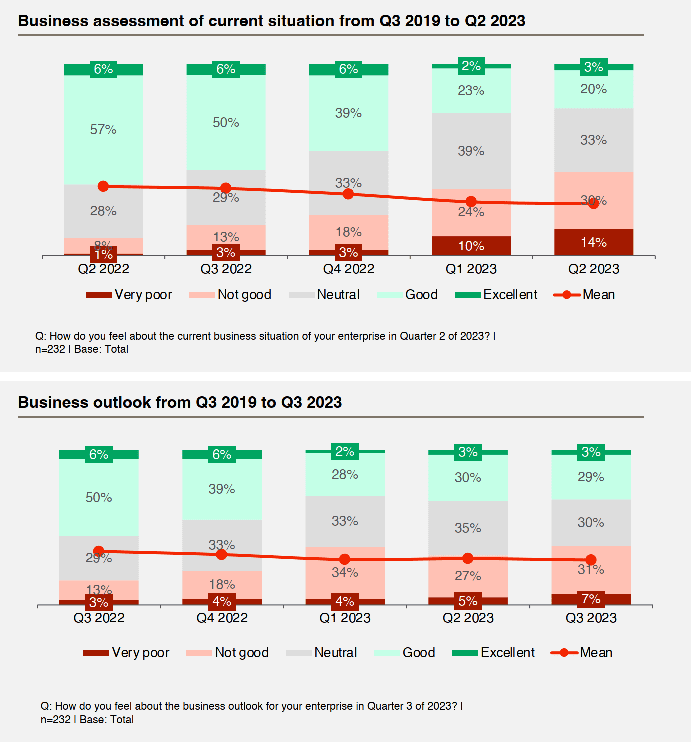

Outlook Amidst Growing Caution and Strategic Planning

The BCI reveals a challenging outlook, with a significant 10% increase in negative responses regarding the current business situation. This growing sense of caution is further reflected in a 6% rise in negative sentiment for the upcoming quarter.

However, amidst the challenges, there is also a glimmer of encouraging news. The report shows a 9% increase in the number of business leaders who assess their business prospects positively for Q3 2023 compared to their assessment for Q2 2023.

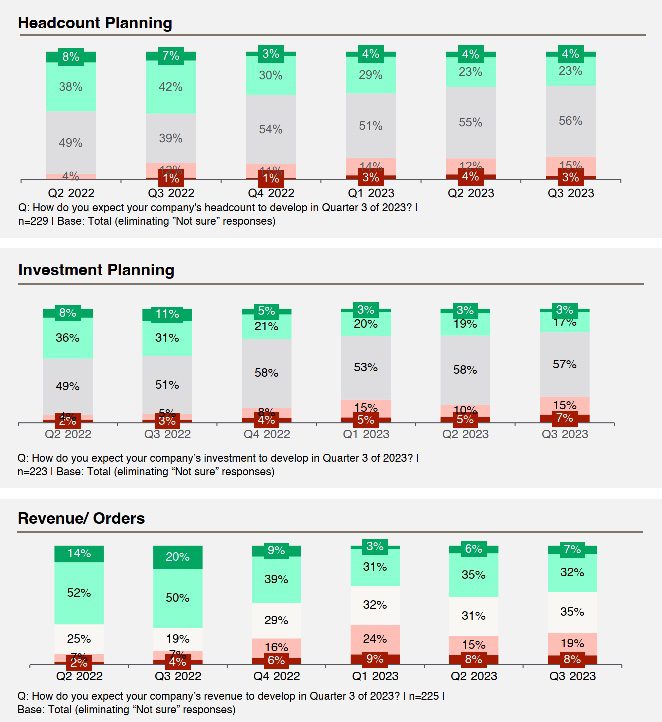

Businesses are prudently assessing the landscape, focusing on optimizing revenue and orders, with a marginal increase of 4% in the proportion of companies anticipating a decline in these areas. Additionally, there is a proactive approach, as 7% more companies plan to carefully manage investments in the upcoming quarter. It is intriguing to note that despite these challenges, workforce planning remains stable, reflecting a resolute commitment to maintaining stability regardless of the prevailing conditions.

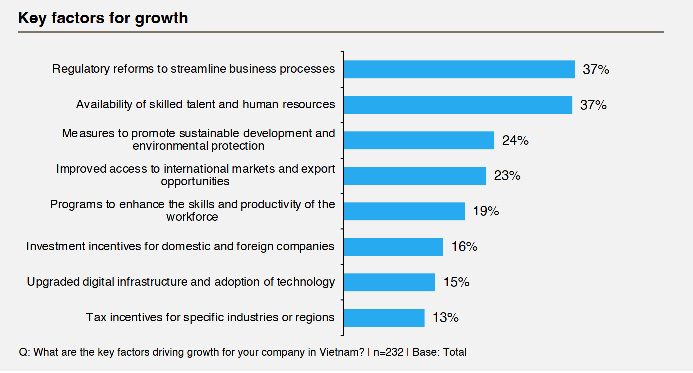

Drivers of Growth: Regulatory Reforms and Skilled Labor

In the current cautious business climate, respondents highlight regulatory reforms and the availability of skilled labor as crucial drivers for their companies’ growth. Regulatory reforms are deemed the primary factor contributing to the growth in the service sector, while the manufacturing sector places significant emphasis on the availability of skilled labor.

Challenges with Visas and Work Permits for Foreign Workers

Securing visas and work permits for foreign workers continues to pose persistent challenges, with over 80% of surveyed businesses encountering various difficulties. The prolonged processing time for obtaining visas and work permits emerges as the most pressing issue. Additionally, nearly half of the surveyed companies struggle with justifying the hiring of foreign workers, hindering knowledge transfer to Vietnamese personnel in three-quarters of the companies surveyed.

Impact of Power Shortages on Operations

The report highlights the pressing concern of power shortages that significantly impacted businesses during the survey period. Although there has been some relief due to recent rainfall, around 60% of respondents experienced the repercussions of these shortages on their business operations. This manifested in reduced operational efficiency, decreased productivity, and disruptions in production and services. Ensuring long-term solutions to address power supply stability remains a priority for sustaining business performance and overall economic resilience.

Perception of Inadequate Infrastructure Development

Furthermore, the report highlights the perception among European business leaders of inadequate infrastructure development in Vietnam, with 53% expressing their views that it is currently “very inadequate” or “lagging behind.” However, the Vietnamese government has been taking proactive measures to address this concern. Notably, there is a strong focus on accelerating key infrastructure projects, particularly in the area of highways.

Vietnam’s Appeal to Foreign Investors

Despite the challenges, Vietnam continues to attract foreign investors, with 48% of respondents expecting an increase in their company’s foreign direct investment (FDI) in the country next quarter. However, a total of 40% of businesses express no plans for elevated FDI, marking a 4% increase from the previous BCI. Nevertheless, Vietnam remains firmly positioned among the top five investment destinations for over one-third of businesses, underscoring its enduring appeal.

Barriers to Foreign Direct Investment

Respondents highlight the importance of improving the regulatory environment, developing infrastructure, and ensuring access to financing to enhance Vietnam’s attractiveness for FDI. The report also emphasizes that unclear regulations and onerous administrative procedures are the primary barriers hindering FDI, with 53% and 50% of businesses, respectively, citing them as the most significant regulatory obstacles impeding their operations in Vietnam.

Relocation of Operations from China to Vietnam

Intentions and actual relocation of operations from China to Vietnam are subdued, with the majority (81%) of companies not having relocated any operations. Among them, only a marginal 3% are considering relocation, while 2% have actively planned for the move.

Concerns about the Global Minimum Tax and Personal Data Protection

The report further highlights concerns expressed by close to 40% of surveyed respondents regarding the forthcoming implementation of the global minimum tax. Similarly, around 42% of businesses report inadequate understanding of Vietnam’s Personal Data Protection Decree, indicating the need for further education on this matter.

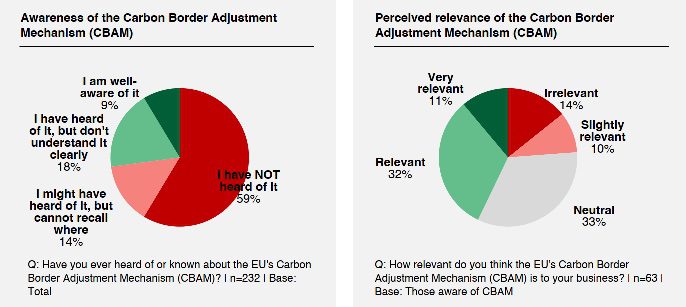

Awareness and Perceptions of the Carbon Border Adjustment Mechanism (CBAM)

Awareness of the Carbon Border Adjustment Mechanism (CBAM) is demonstrated by 27% of respondents, with only 43% perceiving CBAM as relevant to their business activities. Compliance requirements, bureaucratic procedures, and the necessary adaptation of business processes are among the top concerns expressed regarding CBAM.

Benefits and Challenges of the European Union-Vietnam Free Trade Agreement (EVFTA)

The survey reveals that over half of the businesses surveyed have benefited from the European Union-Vietnam Free Trade Agreement (EVFTA). Among these beneficiaries, 35% of business leaders have reported gains from tariff reductions. Despite these gains, businesses continue to face challenges in fully capitalizing on the agreement, with administrative procedures and a lack of understanding remaining the main barriers to full capitalization.

Commenting on the BCI, EuroCham Chairman Gabor Fluit said:

“Vietnam’s economy relies heavily on manufacturing and exports, and it has taken a big hit from the tough global situation. This decline in exports and orders has had a major impact on European businesses and the overall business community. The Business Confidence Index (BCI) clearly shows this current gloomy outlook.”

“To address these challenges, the Vietnamese government has swiftly taken practical steps, particularly by expediting key infrastructure projects. We commend these efforts, which will surely bring a substantial long-term boost to the economy!”

“However, our members have expressed genuine concerns about the issues raised in the BCI report, and we have been actively collaborating with the government to find effective solutions. For instance, it is crucial for the government to come up with long-term plans to address the recent power shortage problem, considering its cyclic nature. By taking prompt and comprehensive action, we can not only attract foreign investment but also ensure a resilient economy capable of overcoming future obstacles. Time is of the essence, and we must act decisively to secure a prosperous future for Vietnam. Rest assured, EuroCham is fully committed to providing support through ongoing dialogue and policy consultations every step of the way.”

CEO of Decision Lab Thue Quist Thomasen added:

“In the previous quarter, we found ourselves at a crucial turning point, where companies adopted a cautious ‘wait and see’ approach to assess the direction of the economy. The most recent BCI results indicate a decrease in optimism compared to the previous quarter.”

“During this trying time, the data suggests that the service sector shows resilience while challenges persist within the manufacturing sector. Overcoming regulatory and infrastructure limitations is vital for smooth operations and increased productivity for businesses to further foster sustainable growth and attract foreign investment.”

“Businesses are expressing that reducing administrative difficulties and upskilling the labor force will facilitate growth. A quality workforce has also proven to be crucial for businesses to maintain their confidence in their own enterprises and the economy.”

To read the full Q2 2023 Business Confidence Index report, click here.

Want to access the press release for the Q2 2023 BCI? Click here for English and here for Vietnamese.