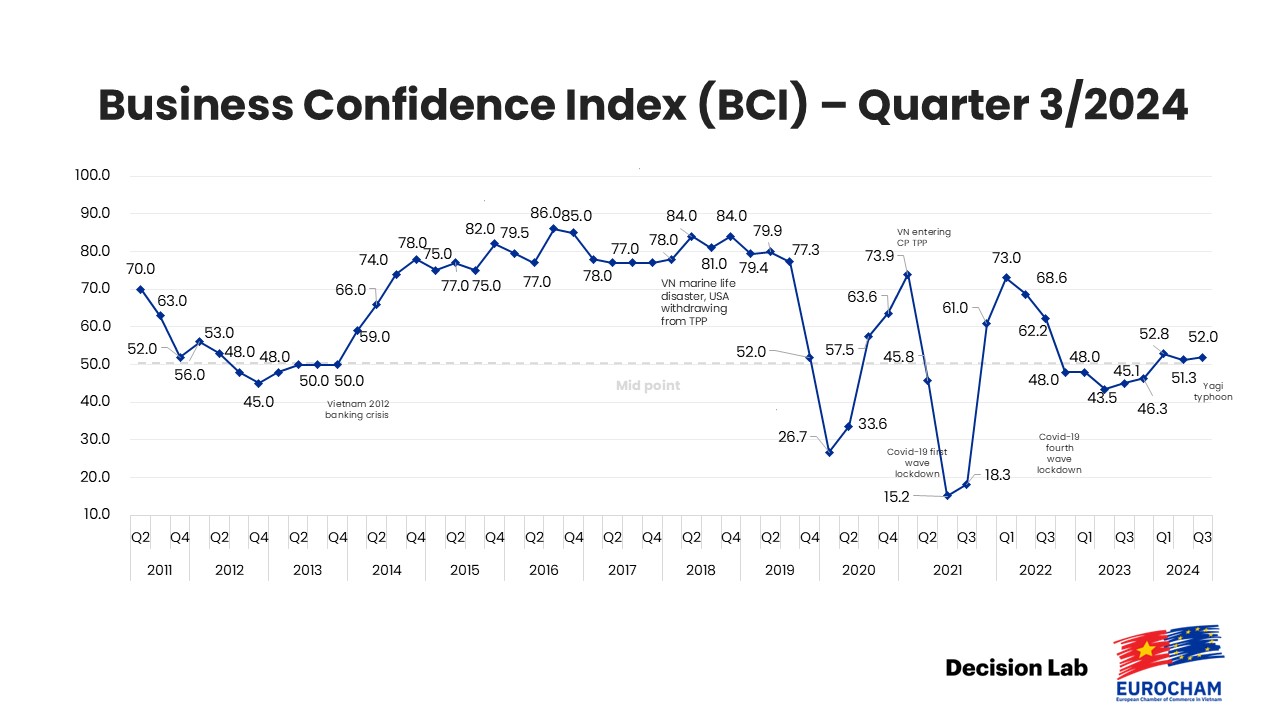

[Vietnam, 8 October 2024] The European Chamber of Commerce in Vietnam (EuroCham Vietnam) has released its Q3 2024 Business Confidence Index (BCI) report, reflecting a positive trend in business sentiment despite the economic challenges posed by Typhoon Yagi and operational hurdles. The BCI score saw a notable increase, rising from 45.1 in Q3 2023 to 52.0 this quarter, signalling a strong year-on-year recovery despite tough external conditions.

EuroCham’s BCI survey is conducted by Decision Lab to gather and analyse insights from the chamber’s network of 1,400 members. This quarterly assessment acts as a barometer of sentiment among European businesses operating in Vietnam, providing real-time insights into the evolving business landscape of one of Southeast Asia’s most dynamic markets. The BCI gauges perceptions of current conditions and future expectations, helping to inform strategic decisions and policy advocacy.

Click here to access the full Q3 2024 BCI report: English version | Vietnamese version

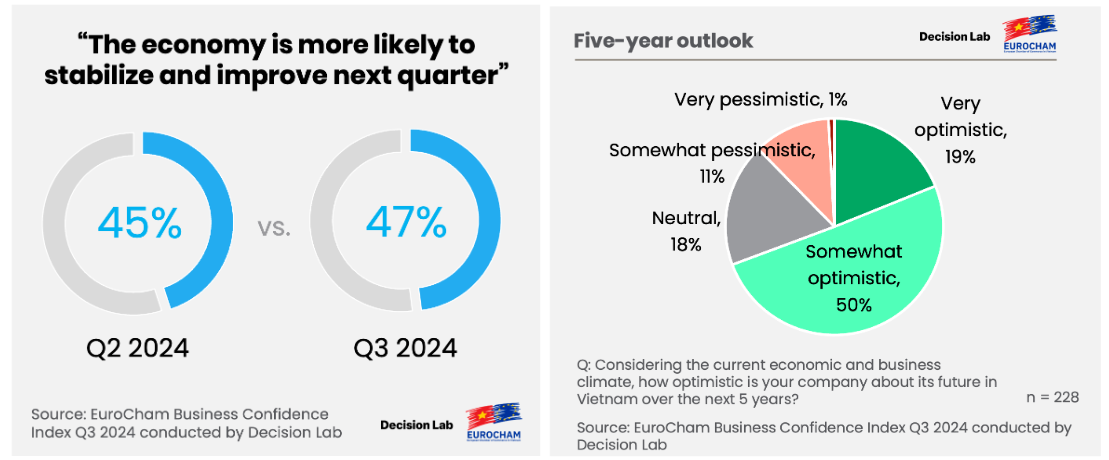

The damage caused by Typhoon Yagi, which has severely impacted the infrastructure and agricultural sectors in Northern Vietnam, has led the Vietnamese government to forecast a 0.15% reduction in GDP for 2024, with estimated losses reaching $1.63 billion. Yet EuroCham’s latest survey, conducted after the typhoon from 12 to 25 September, shows that nearly half (47.4%) of respondents are confident their companies will see improvement in the coming quarter. Additionally, long-term optimism remains high, with 69.3% expecting a favourable business climate over the next five years.

This positive outlook is further reinforced by Vietnam’s continued appeal as an investment destination, with 67% of European businesses still recommending the country despite ongoing challenges.

“Despite the recent economic strain caused by Typhoon Yagi, the resilience and adaptability of both the Vietnamese economy and European businesses operating here are evident in this latest survey. These results are not just numbers; they tell a story of Vietnam’s evolving role as a strategic business hub,” said Bruno Jaspaert, Chairman of EuroCham Vietnam. “The typhoon’s impact also highlights the urgent need to address climate change, making the Green Economy Forum & Exhibition (GEFE) 2024, from 21 to 23 October, a timely platform to drive necessary dialogue on how Vietnam can remain competitive while transitioning towards a greener, more sustainable future.”

Operational challenges continue, but solutions are on the horizon

As in previous quarters, the survey shows that the top three operational obstacles for European businesses are administrative burdens, unclear regulations, and difficulties in obtaining licenses and permits.

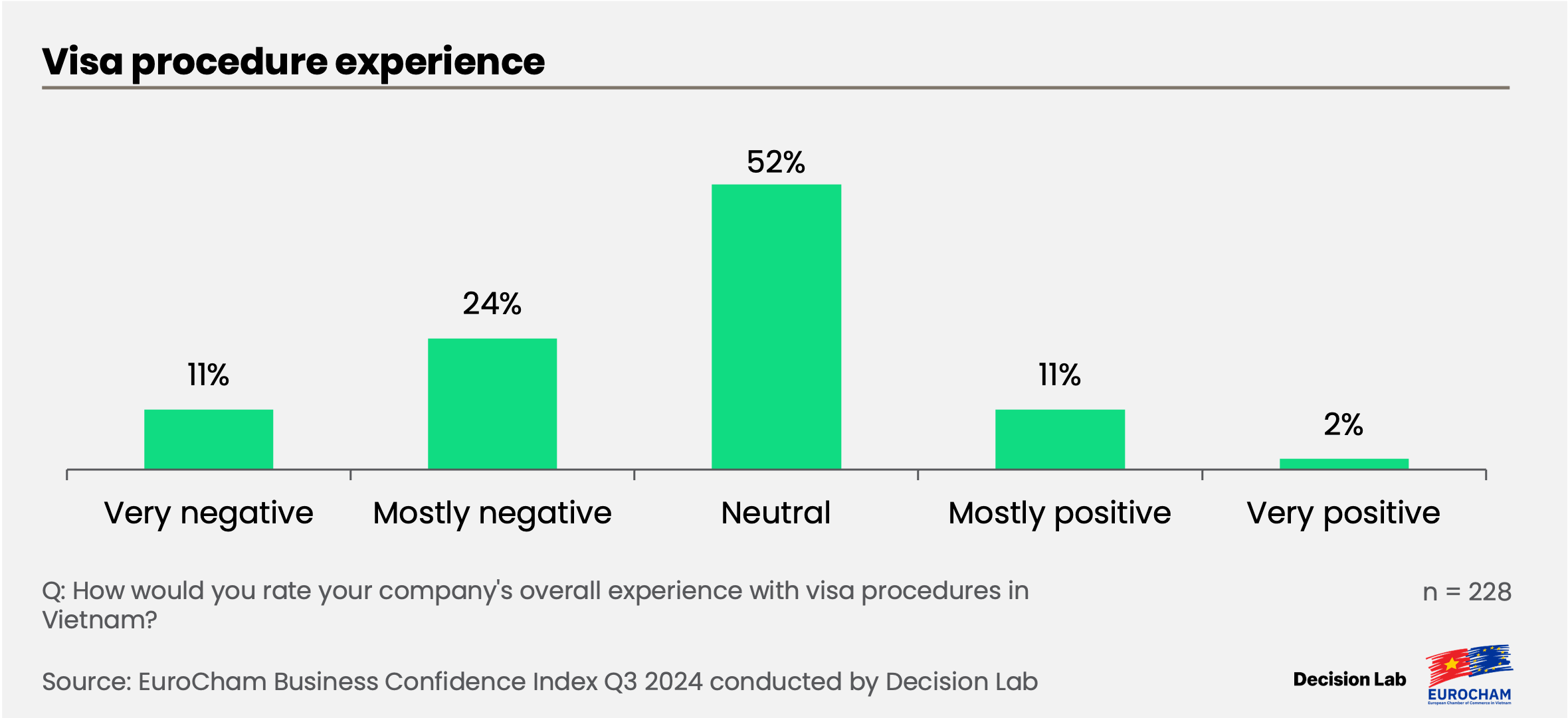

A significant 66% of companies employ between 1% and 9% foreign workers, with only 6% employing more than 20%. While businesses are eager to tap into both local and international talent, barriers to hiring Vietnamese staff include the lack of necessary skills and experience, high turnover rates, and limited resources for training. For foreign experts, visa and work permit complexities, restrictive labour regulations, and high costs remain key obstacles, compounded by difficulties in obtaining necessary licences and approvals.

These hiring challenges are compounded by the negative experiences that one-third of respondents report with Vietnam’s visa system, discourage many foreign professionals from bringing their expertise to the country.

Additionally, companies noted persistent hurdles in tax-related processes and compliance with firefighting regulations.

Green transition and Digitalisation take centre stage

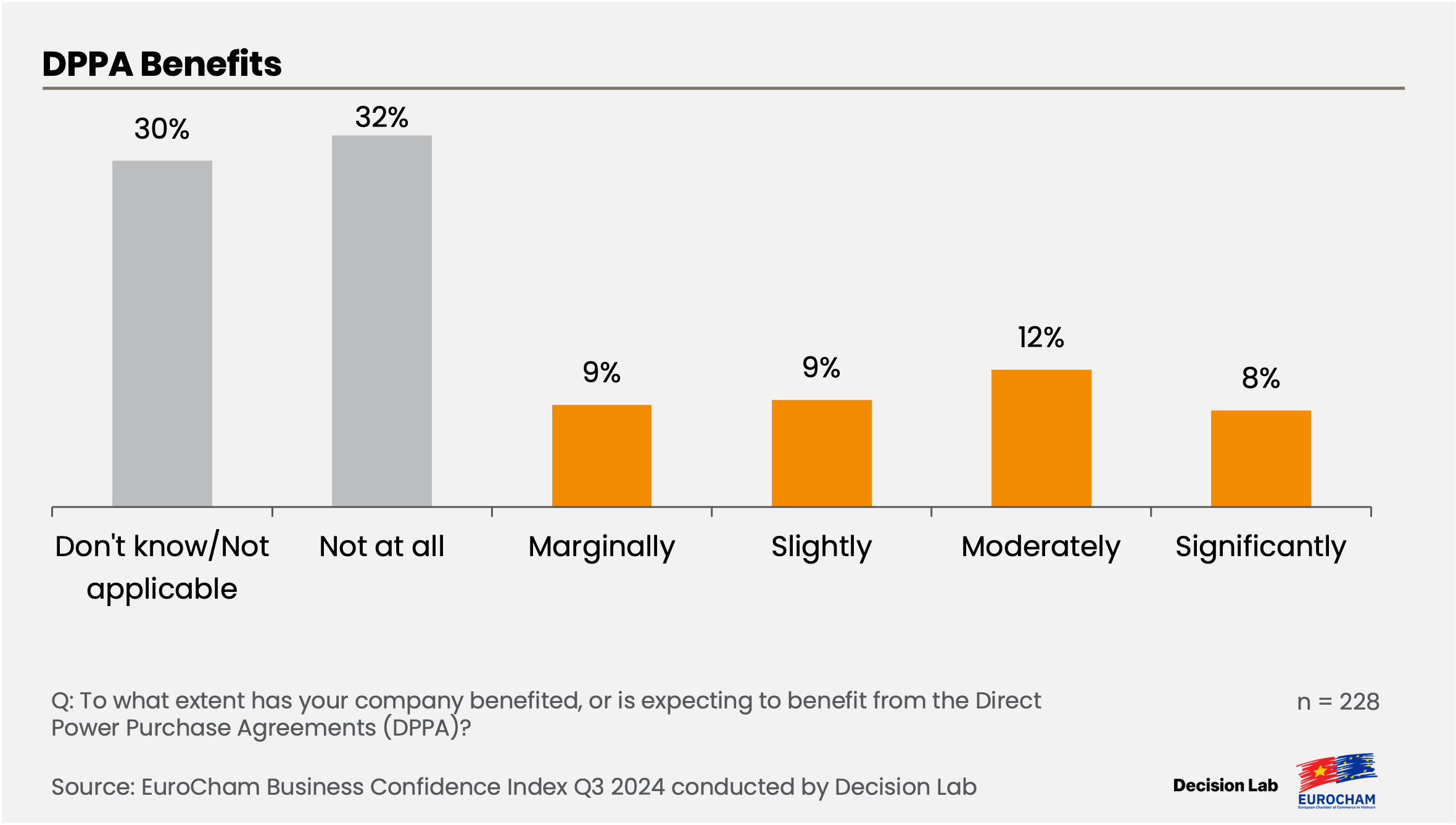

Following the new Decree on the mechanism for Direct Power Purchase Agreement (DPPA) issued in July this year, nearly 30% of respondents expect to benefit from renewable energy projects, further solidifying Vietnam’s commitment to a green transition. One in four service providers and companies with 100 or more employees anticipate the DPPA will benefit them moderately or significantly. While approximately half (47.4%) of surveyed businesses are confident in their ability to fully transition to renewable energy by 2050, gaps remain in policy understanding and implementation.

“GEFE 2024 will provide a timely platform for addressing these gaps,” said Jaspaert. “At the conference, we’ll delve into key topics like energy transition and digitalisation, not only in terms of technical infrastructure but also in fostering green leadership and building sustainable ecosystems across industries.”

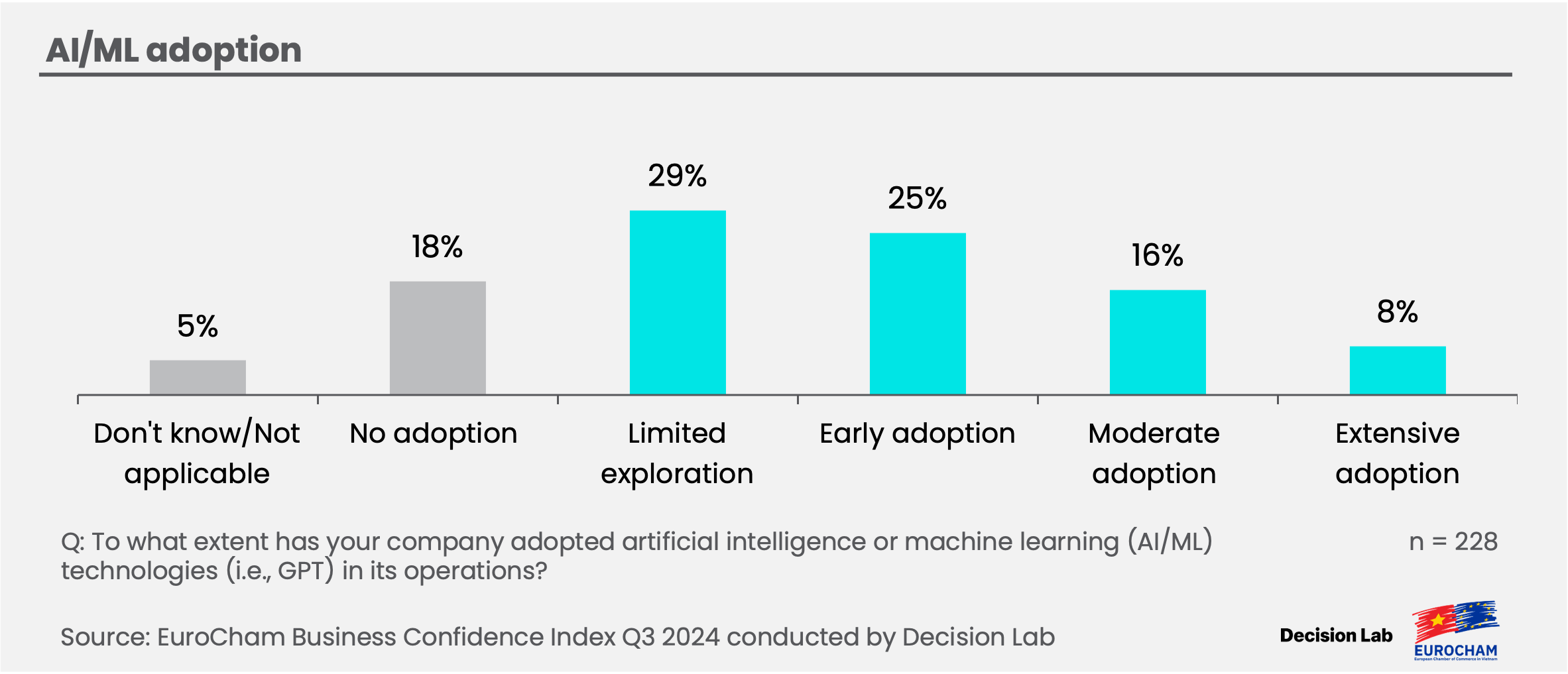

Digitalisation was also identified as a critical area for improvement, particularly in alleviating human resource constraints and streamlining administrative processes. The BCI survey revealed a moderate rate of AI/ML adoption, with 46.1% of companies reporting to have adopted AI/ML in their operations. However, most adoption remains in the early stages, pointing to substantial opportunities for investment in digitalisation projects.

“While the survey shows an overall improvement, the challenges highlighted—particularly in digitalisation—underscore the need for concerted efforts to enhance these areas,” said Thue Quist Thomasen, CEO of Decision Lab. “The adoption of technology will be pivotal for companies to streamline processes and adapt to sustainable standards in the future.”

Business travel and expansion trends

In addition to digitalisation, businesses are adapting their travel strategies in response to rising airfares. Over 40% of respondents reported becoming more selective with their business trips or opting for alternative transportation due to high travel costs, while some have reduced or cancelled travel plans altogether.

Despite these hurdles, business expansion plans remain strong, with close to 80% of companies reporting 1-3 offices or manufacturing units in Vietnam. Among businesses that shared their expansion plans, over half plan to expand operations, with many intending to establish new manufacturing facilities in the North or open additional offices in key cities such as Hanoi, Ho Chi Minh City, Da Nang, and Can Tho.

###

About the Business Confidence Index survey

The quarterly Business Confidence Index (BCI), conducted by Decision Lab, serves as a vital tool for understanding the perceptions of European and Europe-related companies and investors in the Vietnamese market. Conducted since 2011, the BCI collects feedback from EuroCham Vietnam’s extensive network of 1,400 members across a diverse range of sectors. This survey provides valuable insights into the current business landscape in Vietnam and expectations for its future.

Decision-makers, media, and business professionals see the BCI as a key indicator of economic activity in the country. It is a trusted source of information on the business environment in Vietnam, and its findings are widely used to inform government policies and investment decisions.

About EuroCham Vietnam

Founded in 1998, the European Chamber of Commerce in Vietnam (EuroCham) has established itself as the unified voice of the European business community in Vietnam. With offices in Hanoi and Ho Chi Minh City, we represent a diverse spectrum of companies, ranging from small and medium-sized enterprises to multinational corporations. EuroCham plays a crucial role in shaping policy dialogues, fostering bilateral trade and investment, and fortifying economic ties between Europe and Vietnam, particularly within the framework of the EU-Vietnam Free Trade Agreement (EVFTA).

EuroCham Vietnam boasts a substantial membership base comprising over 1,400 companies, solidifying its position as one of the largest foreign chambers operating in Vietnam. We function as the “chamber of chambers,” encompassing nine prominent national European business associations in Vietnam, which include:

- Belgian-Luxembourg Chamber of Commerce (Beluxcham)

- Central and Eastern European Chamber of Commerce in Vietnam (CEEC)

- Chamber of Commerce and Industry Portugal-Vietnam (CCIPV)

- Dutch Business Association Vietnam (DBAV)

- French Chamber of Commerce and Industry Vietnam (CCIFV)

- German Business Association (GBA)

- Italian Chamber of Commerce in Vietnam (ICHAM)

- Nordic Chamber of Commerce Vietnam (Nordcham)

- Spanish Chamber of Commerce in Vietnam (SCCV)

This diversity allows EuroCham to champion the interests of a broad spectrum of industries and businesses, amplifying their collective voice and influence. EuroCham’s diversified influence is underpinned by our extensive network of 20 specialised Sector Committees. Serving as think tanks within their respective industries, these committees provide invaluable expertise, steer policy recommendations, and stimulate industry-specific dialogues. This organisational framework guarantees that the concerns and viewpoints of diverse sectors are actively considered, thereby moulding EuroCham’s cross-sectoral agenda and magnifying its overall influence.

For more information, please visit: www.eurochamvn.org.

For any media enquiries, please contact: EuroCham Vietnam, Media & Communications Officer – Ms. Tram Hoang via tram.hoang@eurochamvn.org.