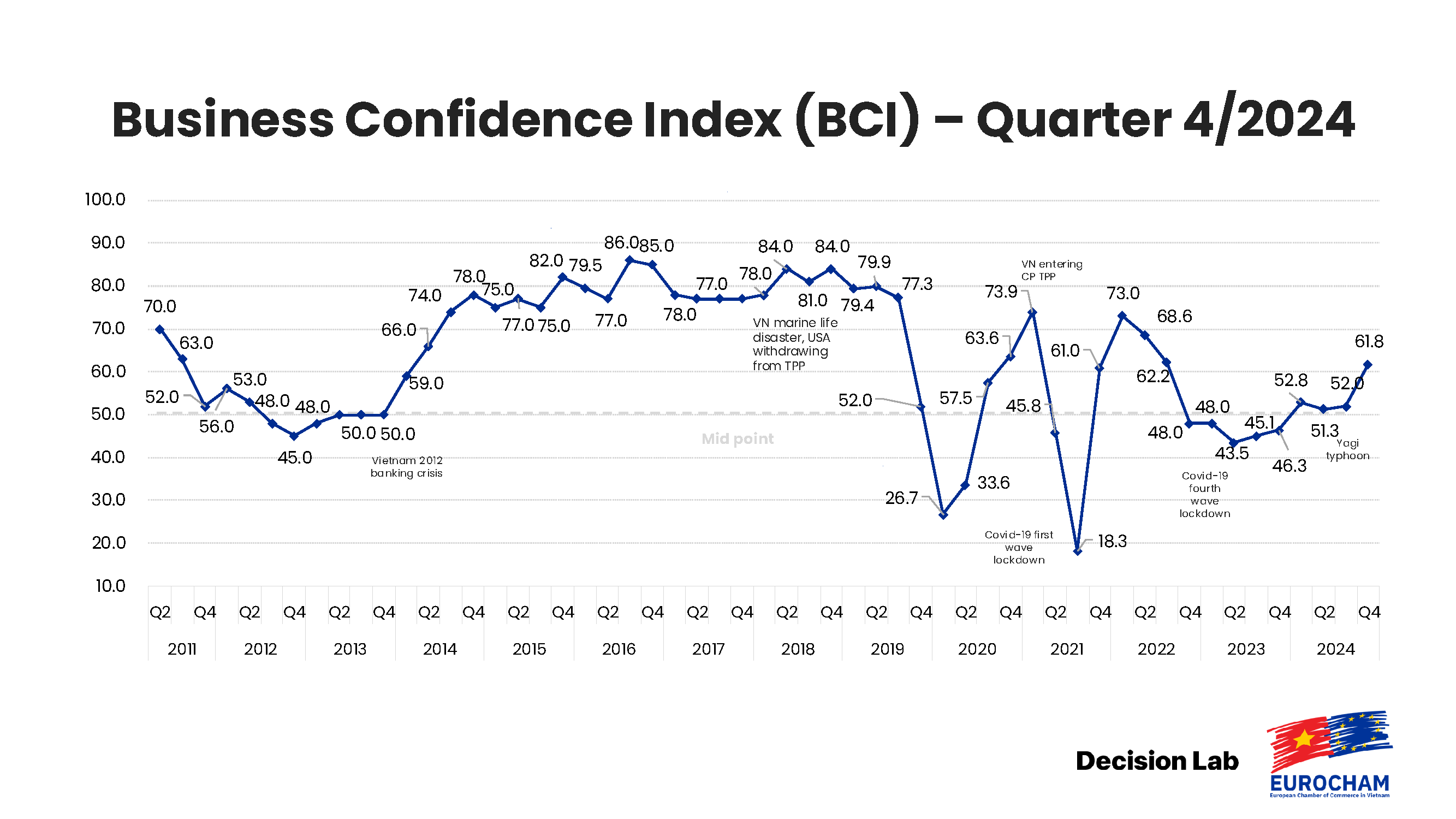

The European Chamber of Commerce in Vietnam (EuroCham Vietnam) has released its Q4 2024 Business Confidence Index (BCI) report, revealing a significant rise in business sentiment, which reflects resilience amidst a turbulent global landscape, in terms of economics, environment, and geopolitics. The BCI score surged from 46.3 in Q4 2023 to 61.8 in Q4 2024, marking a pivotal shift from a neutral to a positive sentiment in both current and future outlooks. This surge comes despite ongoing operational hurdles and global economic uncertainties. Vietnam’s strong performance is, in part, attributed to the country’s continued growth trajectory, its improving infrastructure, and its emergence as a regional hub for both trade and investment.

Click here to access the full Q4 2024 BCI report: English version | Vietnamese version

EuroCham’s Business Confidence Index, conducted by Decision Lab, serves as an important tool for gauging the sentiment of European businesses in Vietnam, providing valuable insights into the challenges and opportunities they face in the country’s dynamic market.

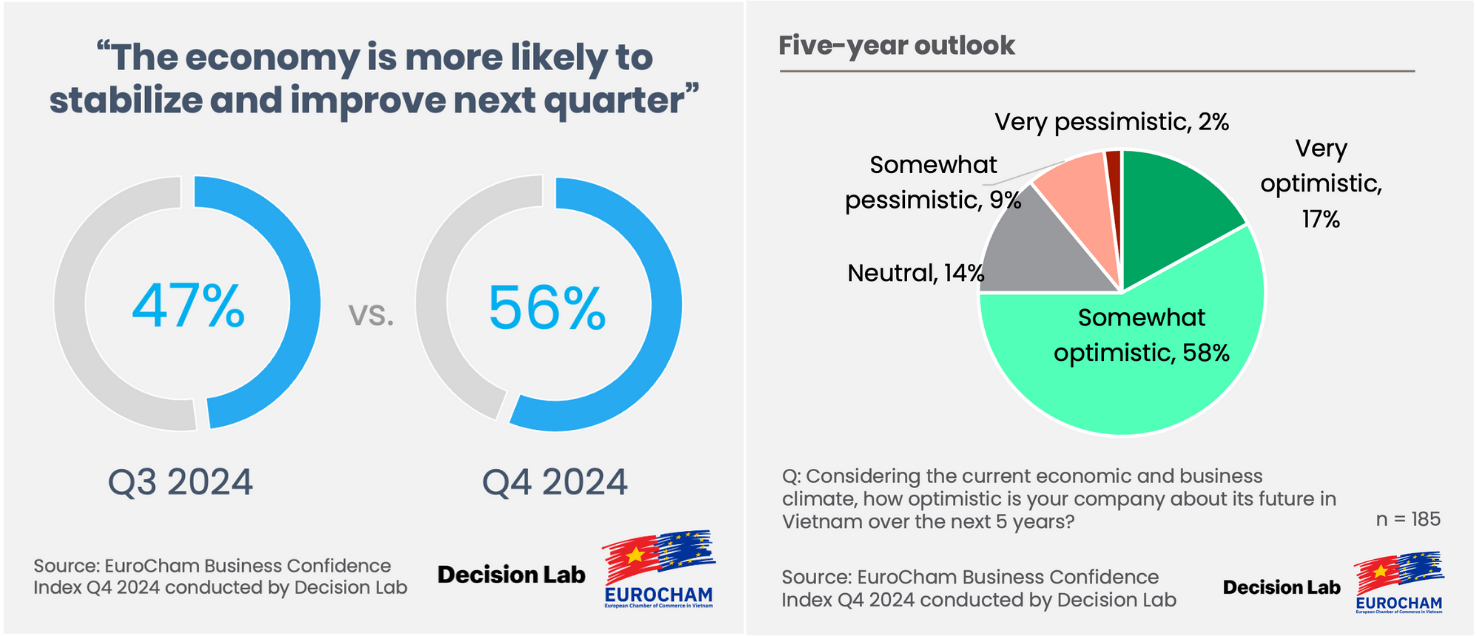

For much of the past two years, the BCI hovered around the neutral midpoint of 50, dipping below it on occasions. The Q4 2024 report, however, marks a pivotal shift as the score reached its highest level since early 2022. According to the survey, 42% of respondents reported feeling positive about the current business situation, with 47% anticipating similarly optimistic conditions for the upcoming quarter. More prominently, 56% of respondents foresee improvements in Vietnam’s macroeconomic outlook in the first quarter of 2025.

“This is a clear sign that European businesses are increasingly confident about Vietnam’s economic future,” said Bruno Jaspaert, Chairman of EuroCham Vietnam. “This clear rise in sentiment reflects a broader recognition of the country’s ongoing political and economic transformation it has seen over the past year(s). The country’s GDP growth confirms its position as a central player in Southeast Asian regional trade and investment.”

The uptick in business confidence can be attributed to several factors, most notably Vietnam’s ongoing economic reforms and its centrality in the global shift toward sustainability. Notably, many respondents referenced the “double transformation” of digital and green transitions as key drivers of optimism. Businesses that have embraced these trends reported significant growth, with some even citing a 40% increase in revenue compared to the previous year. The trend toward sustainability, spurred by both government policy and global pressures, is becoming a significant factor in shaping business strategies across multiple sectors.

The Vietnam Advantage: Rising as a Key Investment Destination

Perhaps most notably, 75% of survey respondents indicated they would recommend Vietnam as an investment destination. This data underscores the growing recognition of Vietnam’s strategic importance as an investment hub within Southeast Asia. With its strong growth rates and expanding infrastructure, Vietnam has positioned itself as an attractive destination for European businesses looking to expand in the region.

“The growing confidence in Vietnam as an investment destination is a testament to the country’s solid foundations in both trade and economic policy,” remarked EuroCham’s Chairman. “Despite the global challenges, Vietnam’s positive investment climate is creating new opportunities for European companies, especially in key sectors like technology, manufacturing, tourism and renewable energy.”

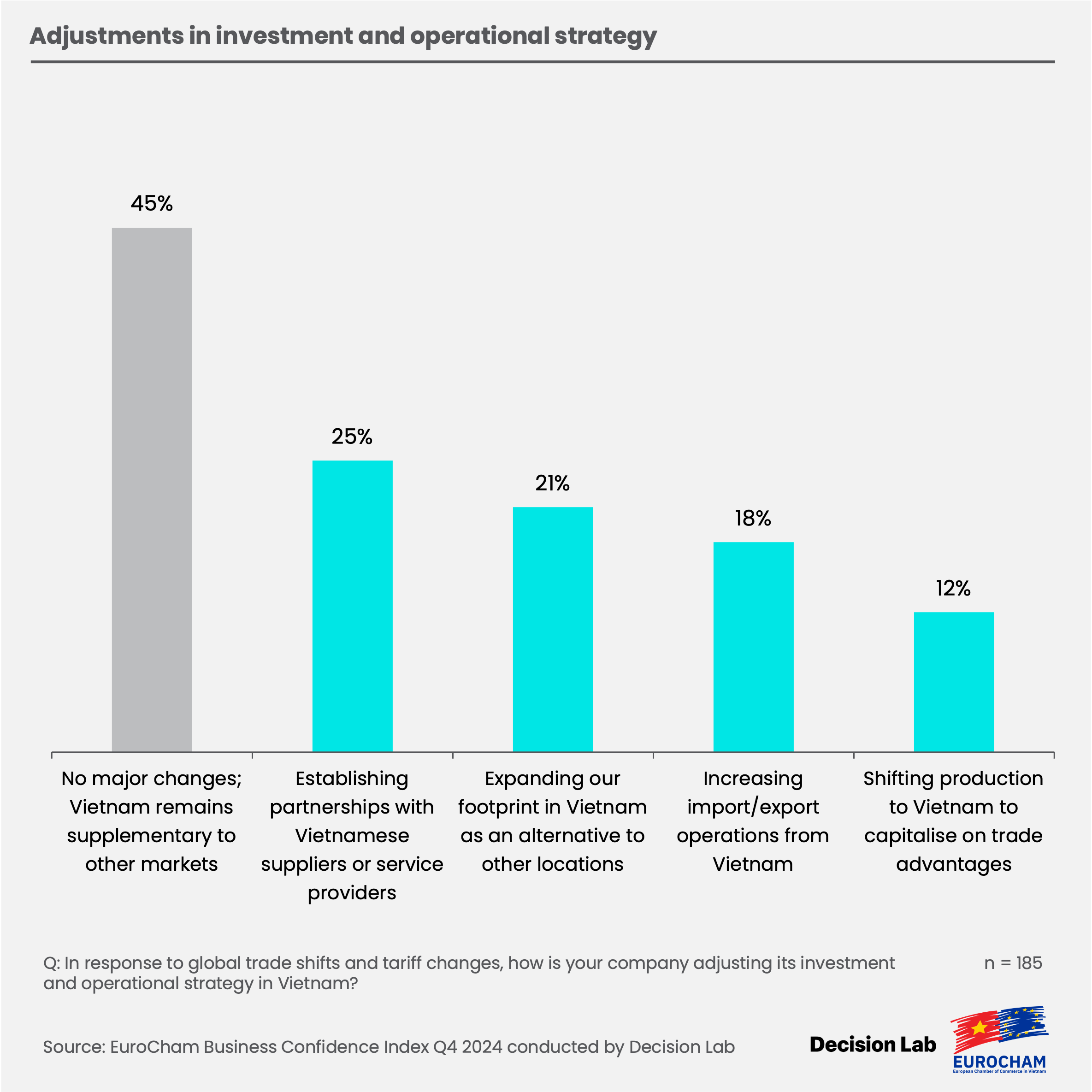

“The data clearly shows that European businesses in Vietnam are increasingly optimistic about the country’s potential as an investment destination,” said Thue Quist Thomasen, CEO of Decision Lab. “A significant portion of businesses indicated plans to expand their operations in Vietnam. Approximately one out of four member companies are considering partnerships with Vietnamese suppliers or service providers, and more than one-fifth of the respondents are looking to expand their footprint in the country. Another 30% are looking to increase their import/export operations and/or shift production to Vietnam. This move aligns with Vietnam’s successful geopolitical positioning amid global trade shifts, particularly in light of recent disruptions to global supply chains.”

Operational Challenges Remain, but Restructuring Efforts Bring Hope

While the overall sentiment is positive, operational challenges continue to be a significant concern for European businesses in Vietnam. As in previous surveys, the top three operational obstacles identified were administrative burdens, unclear regulations, and difficulties in obtaining licenses and permits. The complexities of visa requirements for foreign workers and experts topped the list of administrative challenges, with 42% of responses highlighting this as a primary concern. Tax-related issues, including VAT refunds, were also cited by 30% of respondents, with further challenges related to import/export and investment registration procedures.

“Vietnam is at a critical juncture,” noted Chairman Jaspaert. “These ongoing administrative hurdles challenge business operations, but we are optimistic about the government’s determination to create a more conducive environment. Initiatives such as the steering committee for government restructuring show promise. At EuroCham, we strive to contribute best practices and counsel to debottleneck the current issues. Our annual WhiteBook will focus specifically on these matters and offer implementations to overcome them.”

In November 2024, Prime Minister Pham Minh Chinh announced the formation of a steering committee to restructure Vietnam’s government system. The goal of this initiative is to improve efficiency, decentralise administrative functions, and strengthen local accountability.

Many respondents to the survey expressed optimism that these reforms would lead to significant improvements in administrative processes, with 43% expecting streamlined procedures in the long term, particularly with the adoption of digital platforms and reduced paperwork requirements. However, 36% of respondents also expressed concerns about potential delays in processing applications during the restructuring phase. Despite these challenges, the government’s commitment to digital transformation and e-governance was viewed as a positive step forward by a significant portion of the business community.

Chairman Jaspaert added: “Building Vietnam’s regulatory framework is akin to constructing a house: any house that is built to last starts with a solid foundation. Transparent, clear, and efficient legal processes will enable the country to thrive, improve trade and encourage investors to consider Vietnam to become their newest home. It is my conviction that Vietnam is about to enter its golden era. The current changes in the government’s organisational apparatus are monumental, but the rewards – a thriving economy, increased FDI, and Vietnam’s golden era – will make them worthwhile.”

Infrastructure and Logistics: Key to Future Growth

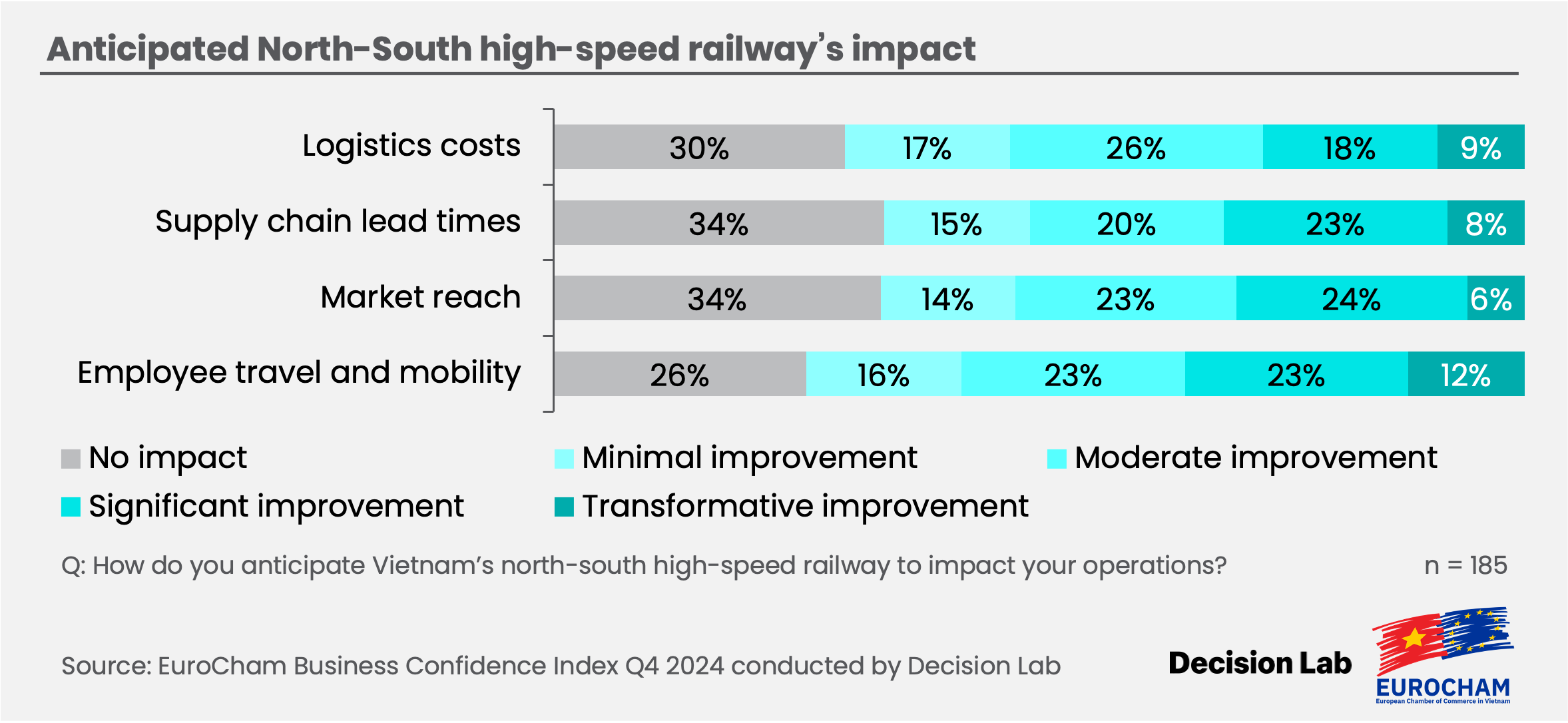

Another area where businesses are expecting significant improvements is in infrastructure. The ongoing development of the North-South high-speed railway, for instance, has garnered considerable attention, with 58% of respondents predicting substantial benefits for employee mobility and logistics. The railway, expected to significantly improve connectivity between the north and south of Vietnam, will reduce transportation costs, improve supply chain efficiency, and enhance the overall business environment.

Nearly 40% of respondents anticipate that these infrastructure upgrades will not only reduce the cost of regional distribution but also bolster connectivity for import and export flows. Furthermore, 12% foresee transformative improvements in employee travel, enabling businesses to optimise operations and attract talent across regions.

Complementing these efforts are advancements in air and maritime infrastructure. Long Thanh International Airport is poised to elevate Vietnam’s logistics playing field, while Hai Phong deep seaports are emerging as a key player in the nation’s maritime economy. Collectively, these infrastructure developments in rail, air, and maritime transport will bolster Vietnam’s position as a more competitive player in regional and global trade, while fostering a more efficient and interconnected business landscape.

Typhoon Yagi: The Resilient Recovery

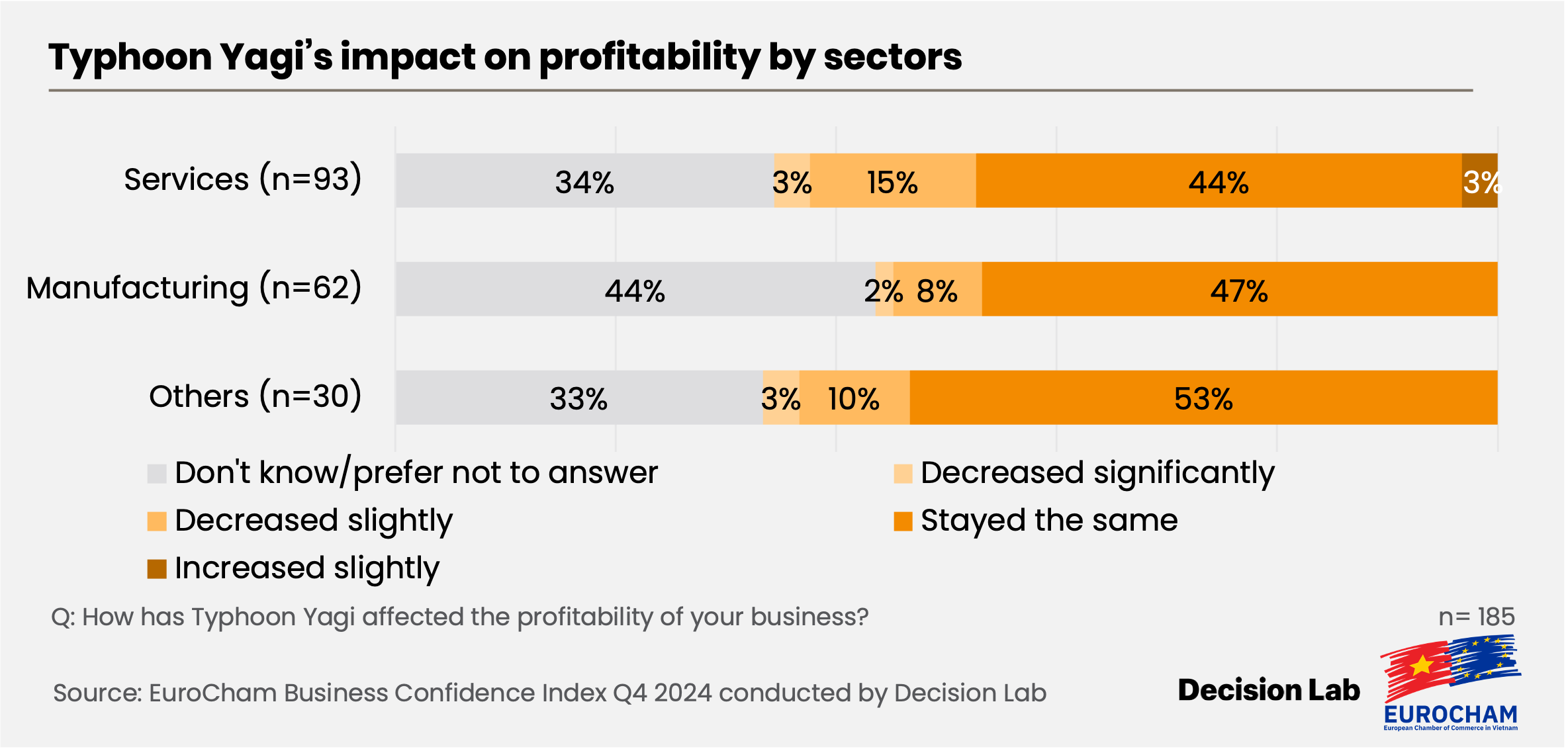

A particularly noteworthy factor influencing this report is the impact of Typhoon Yagi, one of the most powerful storms to hit Vietnam in over three decades. The typhoon devastated 26 localities across the country, accounting for a significant portion of the nation’s GDP and population. Despite the widespread destruction, businesses have shown remarkable resilience in recovering from the disaster.

Three months after the typhoon, 36% of European businesses surveyed had fully recovered, with another 8% expecting to recover in the next quarter. Remarkably, 70% of businesses reported no significant impact to their operations in Vietnam. Only 14% of respondents cited supply chain disruptions, while 12% raised concerns about employee safety and well-being.

Despite these challenges, a majority of respondents across various sectors noted that Typhoon Yagi had little to no impact on their profitability, reflecting the effectiveness of risk management strategies and adaptive measures in place.

“Vietnam’s ability to bounce back from such a devastating natural disaster is a testament to the resilience and adaptability of both its people and its businesses,” said EuroCham’s Chairman. “While challenges remain, the country’s quick recovery demonstrates the strength of its infrastructure and the determination of its business community. In this regard, their response deserves recognition as it trumps the disaster recovery efforts often observed in the European region.”

Following this disaster, the European business community has prioritised strengthening Vietnam’s climate resilience. Efforts focus on improving weather forecasting, establishing robust disaster protocols, and exploring parametric insurance. At the same time, businesses are advancing ESG compliance by setting sustainable targets, reducing pollution, and promoting resilient infrastructure. These efforts not only aim to mitigate the effects of future disasters but also to strengthen Vietnam’s position as a sustainable, forward-thinking business hub.

Looking Ahead: Vietnam’s Role in a Changing World

As the global economic and political landscape continues to evolve, Vietnam’s position as a key player in Southeast Asia becomes increasingly clear. Despite global uncertainties, including fears of further inflation, political instability, and the ongoing tensions affecting supply chains, Vietnam’s economy has remained resilient.

While the trend of urban-to-rural migration has had minimal impacts on workforce planning, companies are cautious about expanding into rural areas, citing concerns about infrastructure and connectivity. As such, the future of Vietnam’s economic growth will likely depend on the continued development of its infrastructure, both in urban and rural areas.

Vietnam’s remarkable economic rebound, as evidenced by the EuroCham Business Confidence Index, signals a promising outlook for European businesses operating in the country. Despite operational hurdles and global uncertainties, businesses are optimistic about Vietnam’s continued growth, with many preparing for the future by expanding operations and investing in long-term strategies.

“As Vietnam continues its transformation, the opportunities for European businesses are clear. With the right policies, infrastructure, and business environment, Vietnam can continue to attract investment and drive sustainable growth in the coming years. It is our duty at EuroCham to support Vietnam on this mission.” – Chairman Jaspaert concluded.

###

About the Business Confidence Index survey

The Business Confidence Index (BCI), conducted by Decision Lab, serves as a vital tool for understanding the perceptions of European and Europe-related companies and investors in the Vietnamese market. Conducted since 2011, the BCI collects feedback from EuroCham Vietnam’s extensive network of 1,400 members across a diverse range of sectors. This survey provides valuable insights into the current business landscape in Vietnam and expectations for its future.

Decision-makers, media, and business professionals see the BCI as a key indicator of economic activity in the country. It is a trusted source of information on the business environment in Vietnam, and its findings are widely used to inform government policies and investment decisions.

About EuroCham Vietnam

Founded in 1998, the European Chamber of Commerce in Vietnam (EuroCham) has established itself as the unified voice of the European business community in Vietnam. With offices in Hanoi and Ho Chi Minh City, we represent a diverse spectrum of companies, ranging from small and medium-sized enterprises to multinational corporations. EuroCham plays a crucial role in shaping policy dialogues, fostering bilateral trade and investment, and fortifying economic ties between Europe and Vietnam, particularly within the framework of the EU-Vietnam Free Trade Agreement (EVFTA).

EuroCham Vietnam boasts a substantial membership base comprising over 1,400 companies, solidifying its position as one of the largest foreign chambers operating in Vietnam. We function as the “chamber of chambers,” encompassing nine prominent national European business associations in Vietnam, which include:

• Belgian-Luxembourg Chamber of Commerce (BeluxCham)

• Central and Eastern European Chamber of Commerce in Vietnam (CEEC)

• Chamber of Commerce and Industry Portugal-Vietnam (CCIPV)

• Dutch Business Association Vietnam (DBAV)

• French Chamber of Commerce and Industry Vietnam (CCIFV)

• German Business Association (GBA)

• Italian Chamber of Commerce in Vietnam (ICHAM)

• Nordic Chamber of Commerce Vietnam (NordCham)

• Spanish Chamber of Commerce in Vietnam (SCCV)

This diversity allows EuroCham to champion the interests of a broad spectrum of industries and businesses, amplifying their collective voice and influence. EuroCham’s diversified influence is underpinned by our extensive network of 20 specialised Sector Committees. Serving as think tanks within their respective industries, these committees provide invaluable expertise, steer policy recommendations, and stimulate industry-specific dialogues. This organisational framework guarantees that the concerns and viewpoints of diverse sectors are actively considered, thereby moulding EuroCham’s cross-sectoral agenda and magnifying its overall influence.

For more information, please visit: www.eurochamvn.org.

For any media enquiries, please contact: EuroCham Vietnam, Media & Communications Officer – Ms. Tram Hoang via tram.hoang@eurochamvn.org.